Delving into Strategic asset allocation vs tactical allocation, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

Strategic asset allocation and tactical allocation are two key approaches in investment management that play a crucial role in shaping investment portfolios. This discussion will explore the differences between these strategies, highlighting their benefits and unique perspectives.

Strategic Asset Allocation vs Tactical Allocation

Strategic asset allocation and tactical allocation are two key investment strategies that differ in their approach and time horizon.

Key Differences

- Strategic Asset Allocation: Involves setting a long-term asset mix based on an investor’s risk tolerance, financial goals, and time horizon. It aims to create a diversified portfolio to meet these objectives over the long term.

- Tactical Allocation: Involves making short-term adjustments to the asset mix in response to changing market conditions or economic outlook. It focuses on taking advantage of short-term opportunities or managing risks.

Examples of Strategic Asset Allocation Strategies

Strategic asset allocation strategies include:

- Equity-Bond Mix: Allocating a percentage of assets to stocks and bonds based on risk tolerance and investment goals.

- Global Diversification: Spreading investments across different regions and asset classes to reduce risk.

- Rebalancing: Periodically adjusting the asset mix to maintain the desired allocation.

Benefits of Tactical Asset Allocation

Utilizing tactical asset allocation in investment portfolios can provide several benefits:

- Opportunistic Investing: Allows investors to capitalize on short-term market inefficiencies or trends.

- Risk Management: Helps in managing risks by adjusting the portfolio in response to changing market conditions.

- Enhanced Returns: Can potentially enhance returns by taking advantage of market opportunities that strategic allocation may overlook.

Comparison of Time Horizons

Strategic asset allocation takes a long-term perspective, focusing on achieving financial goals over an extended period. In contrast, tactical allocation has a short-term focus, aiming to exploit immediate market opportunities or manage risks in the current economic environment.

Asset Management

Asset management in the context of financial planning involves the strategic management of investments to achieve specific financial goals. This process includes selecting, monitoring, and optimizing various assets within an investment portfolio to maximize returns while managing risks effectively.

Primary Objectives of Asset Management

Asset management aims to:

- Preserve and grow capital over time

- Generate income for investors

- Minimize investment risks

- Achieve diversification to spread risk across different asset classes

Role of Asset Management in Optimizing Investment Portfolios

Asset management plays a crucial role in optimizing investment portfolios by:

- Allocating assets strategically based on the investor’s risk tolerance and financial goals

- Regularly monitoring and rebalancing the portfolio to ensure alignment with the investor’s objectives

- Utilizing various investment strategies to maximize returns while minimizing risks

Examples of Asset Management Strategies

Financial professionals employ various asset management strategies, including:

- Strategic Asset Allocation: Setting target allocations for different asset classes and periodically rebalancing the portfolio to maintain those allocations.

- Tactical Asset Allocation: Making short-term adjustments to the portfolio based on market conditions or economic outlook to capitalize on opportunities or manage risks.

- Active Portfolio Management: Actively buying and selling securities to outperform the market or a specific benchmark index.

- Passive Portfolio Management: Replicating the performance of a specific market index by holding a diversified portfolio of securities without frequent trading.

Asset Allocation

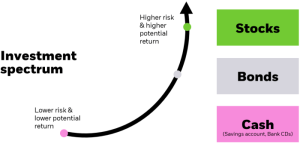

Asset allocation is a crucial component of investment decision-making, where investors distribute their portfolio among different asset classes to achieve their financial goals while managing risk. It involves determining the optimal mix of assets based on factors such as risk tolerance, investment horizon, and financial objectives.

Factors Influencing Asset Allocation Decisions

- Economic conditions: Market trends, interest rates, and inflation can impact asset performance.

- Investor’s risk tolerance: Individuals with a higher risk tolerance may allocate more to equities.

- Time horizon: Longer investment horizons may allow for more aggressive asset allocation strategies.

- Financial goals: Goals such as retirement, education, or wealth preservation can influence asset allocation.

Comparison of Asset Allocation Models

- Strategic Allocation: Involves setting a long-term target allocation and periodically rebalancing to maintain it.

- Tactical Allocation: Involves making short-term adjustments based on market conditions or short-term opportunities.

- Dynamic Allocation: Combines strategic and tactical elements, adjusting allocations based on predefined rules or indicators.

Rebalancing Strategies within Asset Allocation

- Periodic rebalancing involves adjusting the portfolio back to its original asset allocation to maintain risk levels.

- Threshold rebalancing triggers adjustments when asset classes deviate from the target allocation by a certain percentage.

- Constant proportion portfolio insurance (CPPI) dynamically reallocates assets based on market performance to protect against losses.

In conclusion, understanding the nuances of strategic asset allocation and tactical allocation is essential for investors looking to optimize their portfolios. By balancing long-term goals with short-term opportunities, individuals can make informed decisions that align with their investment objectives.

FAQ Corner

What is the main difference between strategic asset allocation and tactical allocation?

Strategic asset allocation focuses on long-term goals and maintains a consistent portfolio mix, while tactical allocation involves adjusting the portfolio based on short-term market conditions.

How do asset management and asset allocation differ?

Asset management involves overseeing investments to achieve financial goals, while asset allocation is the strategy of distributing investments across different asset classes.

Why is rebalancing important in asset allocation?

Rebalancing ensures that the portfolio aligns with the investor’s risk tolerance and investment objectives, maintaining the desired asset allocation mix over time.