With Stocks vs bonds asset allocation at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights in the realm of investment strategies.

This discussion delves into the intricate balance between stocks and bonds, exploring how investors can strategically allocate their assets to manage risk and optimize returns in various economic landscapes.

Stocks vs. Bonds Asset Allocation

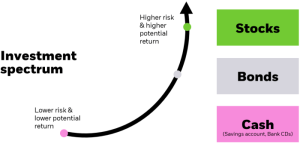

When it comes to investing, stocks and bonds are two popular asset classes that offer different levels of risk and return.

Differences in Risk and Return

Stocks are considered riskier than bonds but also offer higher potential returns. This is because stocks represent ownership in a company and their value can fluctuate significantly based on market conditions. On the other hand, bonds are debt securities issued by governments or corporations, offering a fixed interest rate and a predictable income stream.

Managing Portfolio Risk with Asset Allocation

Asset allocation between stocks and bonds is a key strategy to manage portfolio risk. By diversifying investments across different asset classes, investors can reduce the impact of market volatility on their overall portfolio. This means that when stocks are underperforming, bonds can provide a cushion, and vice versa.

Impact of Economic Conditions

The performance of stocks and bonds is influenced by economic conditions. In a strong economy, stocks tend to perform well as companies generate higher profits. Conversely, in a weak economy, investors may seek the safety of bonds, causing their prices to rise. Understanding these economic factors is crucial for making informed decisions when allocating assets between stocks and bonds.

Asset Management

Asset management is the practice of making decisions and taking actions in order to manage a client’s investments. It involves managing assets such as stocks, bonds, real estate, and other financial instruments to grow the client’s wealth over time. Asset management is a crucial aspect of financial planning as it helps individuals and institutions achieve their financial goals by optimizing their investment portfolios.

Role of Asset Managers

Asset managers play a key role in optimizing investment portfolios by conducting research, analyzing market trends, and making informed decisions on behalf of their clients. They work closely with clients to understand their financial goals, risk tolerance, and time horizon to develop customized investment strategies that align with their objectives.

- Asset Allocation: Asset managers help clients determine the appropriate mix of assets, such as stocks, bonds, and cash, based on their risk profile and investment goals.

- Portfolio Diversification: Asset managers diversify clients’ portfolios across different asset classes and sectors to reduce risk and enhance returns.

- Risk Management: Asset managers monitor market conditions and adjust portfolios as needed to mitigate risks and protect clients’ investments.

Asset managers aim to maximize returns while minimizing risk to help clients achieve their long-term financial objectives.

Asset Allocation Strategies

Asset allocation is a crucial component of investment management, as it involves dividing a portfolio’s assets among different asset classes to achieve a balance between risk and return. There are several asset allocation strategies commonly used by investors to optimize their portfolios based on their risk tolerance and investment objectives.

Strategic Asset Allocation vs. Tactical Asset Allocation

Strategic asset allocation involves setting target allocations for various asset classes and sticking to them over the long term, regardless of market conditions. This approach is based on the investor’s risk tolerance, time horizon, and financial goals. On the other hand, tactical asset allocation involves actively adjusting the portfolio’s asset allocation based on short-term market conditions or opportunities. While strategic asset allocation focuses on the big picture, tactical asset allocation aims to capitalize on short-term market inefficiencies.

Tailoring Asset Allocation to Individual Risk Tolerances and Investment Objectives

Asset allocation can be customized to suit individual risk tolerances and investment objectives by considering factors such as age, income, investment goals, and risk tolerance. For example, a young investor with a long time horizon may opt for a more aggressive asset allocation with a higher allocation to stocks, aiming for higher returns over the long term. On the other hand, a retiree with a lower risk tolerance may choose a more conservative asset allocation with a higher allocation to bonds for capital preservation.

Benefits of Diversification

Diversification is a key strategy in asset allocation that involves spreading investments across different asset classes, industries, and regions to reduce risk and enhance returns.

Reducing Investment Risk

Diversifying across various asset classes such as stocks, bonds, real estate, and commodities can help mitigate the impact of market volatility on a portfolio. When one asset class underperforms, others may perform well, balancing out the overall risk. This can protect investors from significant losses during market downturns.

Enhancing Returns

By diversifying investments, investors can potentially capture the upside of different market sectors and industries that are performing well at any given time. This can lead to a more stable and consistent return on investment over the long term. Additionally, diversification can help investors take advantage of growth opportunities in different regions or sectors, maximizing overall returns.

Geographic and Industry Diversification

Investing in a variety of industries and regions can further reduce risk by minimizing exposure to any single market sector or geographic region. This approach ensures that a downturn in one industry or region does not have a significant impact on the entire portfolio. Geographic diversification also helps protect against country-specific risks such as political instability or economic downturns.

Impact on Risk-Adjusted Returns

Diversification not only reduces risk but also improves risk-adjusted returns. By spreading investments across different assets, investors can achieve a more efficient portfolio that offers a better balance between risk and return. This approach can help investors achieve their financial goals while minimizing the impact of market fluctuations.

As we conclude our exploration of Stocks vs bonds asset allocation, it becomes evident that striking the right balance between these two asset classes is crucial for a well-diversified portfolio that can weather changing market conditions and achieve long-term financial goals.

FAQ Explained

How do stocks and bonds differ in terms of risk and return?

Stocks generally offer higher returns but come with higher risk, while bonds provide lower returns but are considered safer investments.

What role do economic conditions play in the performance of stocks and bonds?

Economic conditions such as interest rates, inflation, and market trends can significantly impact the performance of both stocks and bonds.

How does diversification help in asset allocation?

Diversification spreads investment across different asset classes, reducing overall risk and potentially enhancing returns by offsetting losses in one area with gains in another.