Delving into Portfolio asset allocation tips, this introduction immerses readers in a unique and compelling narrative, with a focus on the importance of strategic management for achieving financial goals. Asset allocation strategies, key factors, and diversification techniques will be explored to provide a comprehensive guide for optimizing investment portfolios.

Importance of Asset Allocation in Portfolio Management

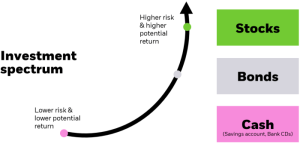

Asset allocation is a crucial aspect of portfolio management as it involves spreading investments across different asset classes to reduce risk and maximize returns.

Diversifying Investment Risk

Asset allocation plays a key role in diversifying investment risk by spreading investments across various asset classes such as stocks, bonds, real estate, and commodities. This diversification helps in minimizing the impact of market fluctuations on the overall portfolio.

Achieving Financial Goals

By strategically allocating assets based on investment objectives, risk tolerance, and time horizon, investors can work towards achieving their financial goals. Asset allocation ensures a balanced approach to investing, taking into account both short-term and long-term financial objectives.

Commonly Included Asset Classes

- Stocks: Represent ownership in a company and offer growth potential.

- Bonds: Provide fixed income and serve as a source of stability in a portfolio.

- Real Estate: Includes properties and real estate investment trusts (REITs) for diversification and potential income generation.

- Commodities: Include physical goods like gold, oil, and agricultural products, offering diversification and a hedge against inflation.

Strategies for Effective Asset Allocation

Effective asset allocation is crucial for achieving investment goals and managing risk. There are various strategies that investors can employ to create a well-diversified portfolio. Let’s explore the different asset allocation strategies and discuss their pros and cons.

Strategic Asset Allocation

Strategic asset allocation involves setting a target mix of assets based on long-term financial goals and risk tolerance. This strategy requires periodic rebalancing to maintain the desired asset allocation.

- Pros:

- Diversification across asset classes helps reduce risk.

- Long-term focus can lead to more stable returns.

- Cons:

- May not adapt well to changing market conditions.

- Requires discipline to stick to the predetermined allocation.

Tactical Asset Allocation

Tactical asset allocation involves making short to medium-term adjustments to the portfolio based on market conditions. Investors using this strategy may shift allocations based on economic indicators or market trends.

- Pros:

- Allows for flexibility to capitalize on short-term opportunities.

- May help to enhance returns during volatile market conditions.

- Cons:

- Requires active monitoring and decision-making.

- Timing the market can be challenging and lead to suboptimal results.

Dynamic Asset Allocation

Dynamic asset allocation combines elements of both strategic and tactical approaches. This strategy involves adjusting the asset mix based on a predefined set of rules or algorithms that respond to changing market conditions.

- Pros:

- Provides a systematic approach to managing risk and return.

- Can adapt to changing market environments more effectively.

- Cons:

- Complexity in designing and implementing the dynamic strategy.

- May involve higher transaction costs due to frequent adjustments.

Choose the most suitable asset allocation strategy based on your investment goals, time horizon, risk tolerance, and level of involvement in managing your portfolio. Each strategy has its own set of advantages and drawbacks, so it’s essential to carefully consider your individual circumstances before making a decision.

Factors to Consider in Portfolio Asset Allocation

When it comes to portfolio asset allocation, there are several key factors that investors need to consider in order to make informed decisions. Factors such as investment horizon, risk tolerance, liquidity needs, economic conditions, and market trends all play a crucial role in determining the optimal asset allocation strategy for a portfolio.

Investment Horizon

The investment horizon refers to the amount of time an investor plans to hold an investment before needing to access the funds. For example, a young investor with a long-term investment horizon may be able to take on more risk in their portfolio compared to an investor nearing retirement who has a shorter time frame. It is important to align asset allocation with the investment horizon to maximize returns while managing risk appropriately.

Risk Tolerance

Risk tolerance is another important factor to consider when determining asset allocation. Investors with a higher risk tolerance may have a higher allocation to equities or alternative investments, while those with a lower risk tolerance may prefer a more conservative allocation with a higher allocation to fixed-income securities. Understanding your risk tolerance is essential in creating a portfolio that aligns with your financial goals and comfort level.

Liquidity Needs

Liquidity needs refer to how easily an investor can convert an investment into cash without significantly impacting the market price. Investors with higher liquidity needs may prefer to have a more liquid portfolio with a higher allocation to cash or short-term investments. On the other hand, investors with lower liquidity needs may be able to hold less liquid assets in their portfolio.

It is important to consider liquidity needs when determining asset allocation to ensure that you have access to funds when needed.

Impact of Economic Conditions and Market Trends

Economic conditions and market trends can have a significant impact on portfolio asset allocation. During periods of economic growth, investors may tilt their portfolios towards riskier assets to capitalize on rising markets. Conversely, during economic downturns, investors may shift towards more defensive assets to protect their portfolios from potential losses. Keeping a close eye on economic conditions and market trends can help investors make timely adjustments to their asset allocation to optimize returns and manage risk.

Adjusting Asset Allocation Based on Market Conditions

It is important for investors to regularly review and adjust their asset allocation based on changing market conditions. Rebalancing the portfolio to maintain the desired asset mix can help investors stay on track with their financial goals and risk tolerance. By periodically reassessing asset allocation and making adjustments as needed, investors can ensure that their portfolios remain well-positioned to weather different market environments and achieve long-term success.

Diversification Techniques for Portfolio Asset Allocation

Diversification is a crucial strategy in portfolio management that involves spreading investments across different assets to reduce risk and minimize the impact of market volatility. By diversifying, investors aim to achieve a balance between risk and return by not putting all their eggs in one basket.

Asset Class Diversification

Asset class diversification involves investing in a mix of different asset classes such as stocks, bonds, real estate, and commodities. Each asset class reacts differently to market conditions, so by diversifying across various classes, investors can reduce the overall risk of their portfolio.

- Diversifying between stocks and bonds can help offset losses in one asset class with gains in another, maintaining a more stable portfolio.

- Including alternative assets like real estate or commodities can further enhance diversification and provide additional sources of return.

Geographic Diversification

Geographic diversification involves investing in assets across different regions and countries to reduce the impact of regional economic events or political risks on the portfolio.

- By spreading investments globally, investors can benefit from growth opportunities in different markets and avoid being overly exposed to the risks of a single country or region.

- Investing in emerging markets alongside developed markets can provide diversification benefits as these regions often have different economic cycles.

Sector Diversification

Sector diversification involves investing in various industry sectors to reduce the risk of being heavily concentrated in a single sector that may underperform due to sector-specific risks.

- By diversifying across sectors such as technology, healthcare, consumer staples, and energy, investors can balance exposure to different industries and benefit from sector rotation strategies.

- Avoiding over-concentration in a single sector can help protect the portfolio from sector-specific downturns while capturing growth opportunities in other sectors.

Monitoring and Rebalancing Portfolio Asset Allocation

Regularly monitoring and rebalancing asset allocation is crucial to ensure that your investment portfolio remains aligned with your financial goals and risk tolerance. As market conditions change and asset classes perform differently, the original asset allocation mix may shift, leading to deviations from your desired risk-return profile. By monitoring and rebalancing your portfolio, you can maintain the desired level of diversification and risk management.

Assessing Portfolio Performance and Rebalancing Asset Allocation

To assess portfolio performance and rebalance asset allocation, follow these steps:

- Review your investment objectives and risk tolerance to determine if they have changed.

- Analyze the current asset allocation in your portfolio and compare it to your target allocation.

- Identify overperforming and underperforming asset classes and rebalance by buying or selling assets to bring your portfolio back to the desired mix.

- Consider tax implications and transaction costs when rebalancing your portfolio.

- Monitor your portfolio regularly to ensure that it remains in line with your investment strategy.

Best Practices for Maintaining an Optimal Asset Allocation Mix

To maintain an optimal asset allocation mix over time, consider the following best practices:

- Set a regular schedule for monitoring and rebalancing your portfolio, such as quarterly or annually.

- Revisit your financial goals and risk tolerance periodically to ensure that your asset allocation aligns with your objectives.

- Stay disciplined and avoid making emotional decisions based on short-term market movements.

- Consider using automated tools or working with a financial advisor to help streamline the monitoring and rebalancing process.

- Stay informed about market trends and economic conditions that may impact your portfolio’s performance.

ASSET MANAGEMENT

Asset management plays a crucial role in optimizing investment portfolios by overseeing the selection, monitoring, and adjustment of assets to achieve the desired financial goals. It involves a strategic approach to managing investments to maximize returns while minimizing risks.

Overview of Asset Management

Asset management is the process of making decisions about how to invest in various asset classes, such as stocks, bonds, real estate, and commodities. The primary objectives of asset management include capital preservation, income generation, and capital appreciation. Unlike asset allocation, which focuses on distributing investments across different asset classes, asset management involves actively managing individual assets within those classes.

- Asset Selection: Asset managers analyze various investment options and choose the ones that align with the portfolio’s objectives and risk tolerance.

- Portfolio Monitoring: Continuous monitoring of assets to ensure they are performing as expected and making adjustments as needed based on market conditions.

- Risk Management: Implementing strategies to mitigate risks and protect the portfolio from potential losses.

- Performance Evaluation: Assessing the performance of assets against benchmarks and goals to make informed decisions for portfolio optimization.

ASSET ALLOCATION

Asset allocation is a crucial aspect of portfolio management that involves dividing investments among different asset classes such as stocks, bonds, and cash equivalents. It plays a vital role in spreading investment risk and achieving optimal returns based on an individual’s financial goals and risk tolerance.

Understanding Asset Allocation

Asset allocation is the strategic distribution of investments across various asset classes to achieve a balance between risk and reward. It is essential for investors to diversify their portfolios to reduce the impact of market volatility on their overall returns.

- Strategic Asset Allocation: This approach involves setting target allocations for different asset classes based on long-term financial objectives and risk tolerance levels. By maintaining a consistent allocation over time, investors can benefit from the potential returns of each asset class while minimizing risk.

- Real-Life Examples: Renowned investors like Warren Buffett and Ray Dalio have successfully implemented asset allocation strategies to build wealth over the years. Buffett, for instance, is known for his focus on value investing in stocks, while Dalio emphasizes diversification across asset classes to manage risk effectively.

In conclusion, mastering the art of portfolio asset allocation is crucial for successful investment management. By understanding the various strategies, factors, and techniques involved, investors can navigate the complex financial landscape with confidence and achieve their long-term objectives.

Q&A

What role does asset allocation play in portfolio management?

Asset allocation is essential for diversifying investment risk and achieving financial goals by strategically distributing assets across different classes.

How can I choose the most suitable asset allocation strategy?

Consider your investment goals and risk tolerance to select a strategy that aligns with your financial objectives.

Why is monitoring and rebalancing asset allocation important?

Regular monitoring ensures that your portfolio stays aligned with your goals, while rebalancing helps maintain an optimal mix over time.