Exploring the realm of selecting an asset management firm, this introduction sets the stage for a comprehensive look at key factors to consider. From researching firms to understanding fee structures, this guide will equip you with the knowledge needed to make sound investment choices.

As we delve deeper into this topic, we will uncover essential insights that can empower you to navigate the complex landscape of asset management firms with confidence and clarity.

Researching Asset Management Firms

When choosing an asset management firm, thorough research is essential to ensure that you are entrusting your investments to a reputable and capable organization. By conducting detailed research, you can make informed decisions that align with your financial goals and risk tolerance.

Criteria to Consider When Evaluating Asset Management Firms:

- Performance Track Record: Look at the firm’s historical performance to assess their ability to generate returns and manage investments effectively.

- Experience and Expertise: Evaluate the qualifications and experience of the firm’s investment team to determine their competency in making investment decisions.

- Investment Approach: Understand the firm’s investment philosophy and strategy to ensure it aligns with your own investment objectives.

- Fee Structure: Consider the fees charged by the firm and how they impact your overall investment returns.

- Client Services: Assess the level of customer service and communication provided by the firm to ensure your needs are met.

Checking the Firm’s Track Record and Reputation:

One of the most crucial aspects of researching asset management firms is examining their track record and reputation in the industry. A firm’s track record can provide valuable insights into their past performance, consistency, and ability to deliver results. Additionally, analyzing the firm’s reputation among clients and industry peers can help you gauge their credibility and trustworthiness.

Asset Management Services Offered

When selecting an asset management firm, it is crucial to understand the various services they offer to meet your investment needs effectively.

Types of Asset Management Services

- Portfolio Management: This service involves the active management of your investment portfolio to achieve specific financial goals.

- Financial Planning: Asset management firms provide personalized financial planning services to help clients reach their long-term financial objectives.

- Risk Management: Firms offer risk assessment and management strategies to protect your investments from market volatility.

- Retirement Planning: Asset management firms assist clients in planning for a financially secure retirement through investment strategies and savings plans.

Comparing Services Among Firms

- Some firms may specialize in certain asset classes, such as equities, fixed income, or real estate, while others offer a diversified range of investment options.

- Consider the level of customization and personalization each firm offers to tailor their services to your unique financial goals and risk tolerance.

- Look for firms that provide transparent fee structures and clear communication on performance metrics to ensure alignment with your investment objectives.

Aligning Services with Investment Goals

- It is essential to choose an asset management firm that aligns its services with your specific investment goals, whether they are focused on growth, income, or capital preservation.

- Discuss your investment objectives and risk tolerance with potential firms to ensure they can provide the right mix of services to help you achieve your financial goals.

- Regularly review and reassess your investment strategy with your asset management firm to make adjustments as needed based on changing market conditions or personal circumstances.

Understanding Fee Structures

When choosing an asset management firm, understanding the fee structures is crucial to making informed decisions about your investments. Different firms have varying fee arrangements that can impact your overall returns.

Common Fee Structures

- Management Fees: These are charged as a percentage of your total assets under management. Typically, they range from 0.5% to 2% annually.

- Performance Fees: These fees are based on the performance of your investments and are usually calculated as a percentage of the profits generated.

- Transaction Fees: Charged for buying or selling securities within your portfolio. These fees can vary depending on the frequency of trading.

Impact on Investment Returns

High fee structures can eat into your investment returns over time, especially if your portfolio is not performing well. It’s essential to consider the impact of fees on your overall returns and choose a firm with transparent and reasonable fee structures.

Fee Negotiation Strategies

- Compare Fee Structures: Research and compare fee structures of different asset management firms to ensure you are getting competitive rates.

- Ask for Fee Breakdown: Request a detailed breakdown of all fees involved, including any hidden costs, to negotiate better terms.

- Consider Fee Caps: Negotiate for fee caps to limit the maximum amount you will pay in fees, especially for high-net-worth individuals.

Asset Allocation Strategies

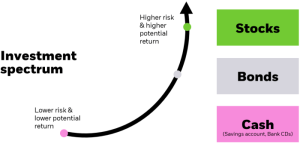

Asset allocation is a crucial component of investment management that involves spreading investments across different asset classes to achieve a balance between risk and return. By diversifying one’s portfolio, investors can reduce the impact of market fluctuations on their overall investment.

Different Asset Allocation Strategies

- Strategic Asset Allocation: This approach involves setting a target mix of asset classes based on the investor’s risk tolerance and investment goals. The allocation is periodically rebalanced to maintain the desired mix.

- Tactical Asset Allocation: In this strategy, asset managers actively adjust the portfolio’s asset allocation based on short-term market conditions and economic outlook. The goal is to capitalize on market opportunities and manage risks.

- Dynamic Asset Allocation: This strategy involves making strategic shifts in asset allocation based on changing market conditions. Asset managers continuously monitor market trends and adjust the portfolio to optimize returns and manage risks.

Benefits of Asset Allocation

Asset allocation can help manage risk by spreading investments across different asset classes that may respond differently to market changes. By diversifying, investors can reduce the impact of volatility in any single asset class on their overall portfolio. Additionally, asset allocation can optimize returns by capturing opportunities in different sectors and asset classes while minimizing the impact of underperforming investments.

In conclusion, choosing the right asset management firm is a crucial step in achieving your financial goals. By following the Artikeld strategies and considerations, you can pave the way for a successful investment journey that aligns with your objectives and risk tolerance.

FAQ Corner

What criteria should I consider when evaluating asset management firms?

Factors such as track record, reputation, services offered, and fee structures are essential to assess when choosing an asset management firm.

How do fee structures impact overall investment returns?

High fees can eat into your returns over time, so it’s crucial to understand the fee structures and negotiate where possible to maximize your investment gains.

What are some common asset allocation strategies used by asset management firms?

Asset allocation strategies include diversification, strategic asset mix, and rebalancing to manage risk and optimize returns based on your investment goals.