Embark on a journey through the realm of asset allocation strategies for 2024, delving into the nuances of diversification and optimal investment paths.

Explore the intricate balance between risk tolerance, time horizon, and asset classes to sculpt a winning portfolio in the upcoming year.

Asset Allocation Strategies

Asset allocation is a crucial component of any investment strategy, determining how your portfolio is divided among different asset classes. In 2024, it is important to consider the best asset allocation strategies to maximize returns and manage risk effectively.

Comparison of Asset Allocation Approaches

There are various asset allocation approaches, each with its own advantages and considerations. Let’s compare and contrast a few common strategies:

- Strategic Asset Allocation: Involves setting target allocations for various asset classes and periodically rebalancing to maintain those targets.

- Tactical Asset Allocation: Involves making short-term adjustments to the portfolio based on market conditions or economic outlook.

- Dynamic Asset Allocation: Utilizes a rules-based approach to adjust allocations based on specific criteria, such as market volatility or valuation metrics.

The Importance of Diversification in Asset Allocation

Diversification is a key principle in asset allocation that helps reduce risk by spreading investments across different asset classes. By diversifying your portfolio, you can potentially minimize losses during market downturns while still benefiting from the growth of various sectors.

Modern Portfolio Theory

Modern Portfolio Theory (MPT) is a framework for constructing investment portfolios based on the principles of diversification, risk tolerance, and expected returns. Developed by Harry Markowitz in the 1950s, MPT emphasizes the importance of not only individual assets but also how they interact within a portfolio.

Influence on Asset Allocation Strategies

MPT has a significant influence on asset allocation strategies by promoting the idea that investors can optimize their portfolios by combining assets with different levels of risk and return. By diversifying across various asset classes, such as stocks, bonds, and real estate, investors can reduce overall portfolio risk while potentially increasing returns.

- One way investors can apply MPT in 2024 is by using a strategic asset allocation approach. This involves setting target allocations for different asset classes based on long-term financial goals and risk tolerance.

- Another application of MPT is through tactical asset allocation, where investors adjust their allocations based on short-term market conditions and economic outlook. This allows for more flexibility in responding to changing market dynamics.

- Investors can also utilize Modern Portfolio Theory by incorporating alternative investments, such as commodities or real assets, to further diversify their portfolios and potentially enhance risk-adjusted returns.

Risk Tolerance and Time Horizon

When it comes to asset allocation strategies, understanding your risk tolerance and time horizon is crucial. These factors play a significant role in determining the appropriate mix of assets in your investment portfolio.

Relationship between Risk Tolerance, Time Horizon, and Asset Allocation

Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. It is influenced by factors such as your financial goals, investment knowledge, and emotional temperament. Time horizon, on the other hand, represents the length of time you expect to hold an investment before needing to access the funds.

- Risk tolerance should directly impact your asset allocation decisions. If you have a high risk tolerance, you may be more comfortable with a portfolio that includes a higher percentage of equities, which have the potential for higher returns but also come with greater volatility. Conversely, if you have a low risk tolerance, you may opt for a more conservative mix of assets, such as bonds or cash equivalents, to minimize potential losses.

- Time horizon plays a significant role in choosing asset allocation strategies. The longer your time horizon, the more risk you may be able to take on in your portfolio. This is because you have more time to ride out market fluctuations and recover from any potential losses. For investors with a shorter time horizon, such as those nearing retirement, a more conservative asset allocation may be appropriate to protect their capital.

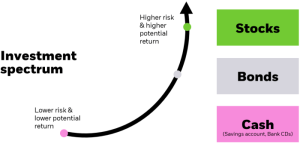

Asset Classes and Allocation

Investing in various asset classes is crucial for a well-diversified portfolio. Let’s explore the different asset classes available for investment and how to effectively allocate assets across them.

Types of Asset Classes

- Equities: Investing in stocks of companies, which can offer high returns but also come with high volatility.

- Bonds: Fixed-income securities issued by governments or corporations, providing steady income and lower risk compared to stocks.

- Real Estate: Investing in physical properties or real estate investment trusts (REITs) for potential appreciation and rental income.

- Commodities: Investing in physical goods like gold, oil, or agricultural products to diversify the portfolio and hedge against inflation.

- Cash and Cash Equivalents: Includes savings accounts, money market funds, and certificates of deposit for liquidity and capital preservation.

Asset Allocation Strategies

- Strategic Asset Allocation: Setting a target mix of asset classes based on risk tolerance and financial goals, and periodically rebalancing to maintain the desired allocation.

- Tactical Asset Allocation: Adjusting asset allocation based on short-term market conditions or economic outlook to capitalize on opportunities or reduce risks.

- Dynamic Asset Allocation: Using a rules-based approach to adjust asset allocation dynamically based on market trends, economic indicators, or valuation metrics.

Rebalancing Asset Allocations

Rebalancing asset allocations is essential to maintain the desired risk-return profile of the portfolio. Periodically review your investments and reallocate assets to bring them back to the target allocation. This helps to control risk exposure and ensure that your portfolio aligns with your investment objectives.

Global Market Trends

Global market trends play a crucial role in shaping asset allocation strategies in 2024. Understanding the current landscape and anticipating future shifts is essential for making informed investment decisions.

Impact of Geopolitical Events

Geopolitical events have the potential to significantly impact asset allocation decisions in 2024. Turbulence in global relations, trade agreements, and political instability can create uncertainty in financial markets, leading investors to adjust their portfolios accordingly. It is important to closely monitor geopolitical developments and their potential effects on different asset classes.

Emerging Market Opportunities

Despite the challenges posed by geopolitical events, there are also emerging market opportunities for asset allocation in 2024. Rapidly growing economies, technological advancements, and demographic shifts in certain regions present new avenues for investment. Diversifying portfolios to include exposure to these emerging markets can help investors capitalize on high-growth opportunities while managing risk effectively.

Tax-Efficient Investing

When it comes to asset allocation, tax-efficient investing is a crucial strategy that aims to minimize the impact of taxes on investment returns. This approach involves making strategic decisions about where to hold different asset classes to maximize after-tax returns.

Optimizing Tax Efficiency

Optimizing tax efficiency in asset allocation plans involves several key strategies:

- Utilizing tax-advantaged accounts such as IRAs and 401(k)s to shield investments from taxes on dividends, interest, and capital gains.

- Consideration of tax implications before rebalancing the portfolio to avoid triggering unnecessary capital gains taxes.

- Choosing tax-efficient investments like index funds or ETFs that typically have lower turnover and therefore generate fewer capital gains distributions.

- Harvesting tax losses by selling investments at a loss to offset capital gains and reduce taxes owed.

Benefits of Tax-Aware Asset Allocation

Tax-aware asset allocation strategies offer several benefits for investors:

- Maximizing after-tax returns, which can significantly impact long-term wealth accumulation.

- Reducing tax drag on investment performance, allowing investors to keep more of their returns.

- Enhancing overall portfolio efficiency by minimizing taxes and optimizing asset location.

Asset Management vs. Asset Allocation

Asset management and asset allocation are two key components of a successful investment strategy, each playing a distinct role in optimizing portfolio performance. Asset management involves the day-to-day decisions made by portfolio managers regarding buying, selling, and holding investments, with the goal of maximizing returns within a specified risk tolerance. On the other hand, asset allocation refers to the broader strategy of diversifying investments across different asset classes (such as stocks, bonds, and real estate) to manage risk and achieve long-term financial goals.

Complementing Asset Management Strategies

Asset management strategies can complement asset allocation by implementing tactical adjustments based on market conditions and investment performance. For example, if a particular sector is expected to outperform in the short term, an active asset manager may increase exposure to that sector to capitalize on potential gains. This active approach can enhance the overall effectiveness of asset allocation by taking advantage of short-term opportunities while still adhering to the long-term strategic allocation plan.

- Utilizing Active Management: Active asset managers can help navigate market volatility and capitalize on emerging trends, adding value to the overall portfolio.

- Risk Management Techniques: Asset managers can employ sophisticated risk management tools to protect downside risk and enhance the risk-adjusted returns of the portfolio.

- Performance Monitoring: Regular performance reviews and adjustments can ensure that the portfolio remains aligned with the investor’s financial objectives and risk tolerance.

As we conclude this exploration, remember the key pillars of asset allocation strategies for 2024: adaptability, diversification, and a keen eye on global market trends.

Helpful Answers

How do geopolitical events impact asset allocation decisions for 2024?

Geopolitical events can introduce volatility and uncertainty, influencing the allocation of assets towards more stable or growth-oriented options.

Why is tax-efficient investing crucial in asset allocation plans?

Tax-efficient investing minimizes tax liabilities, optimizing returns and preserving the wealth accumulated through strategic asset allocation.

What role does rebalancing play in asset allocation strategies?

Rebalancing ensures that the portfolio maintains the desired risk and return profile by adjusting asset allocations back to their target percentages.